Which means they’re in a bubble because Nvidia’s total assets (85B$) value is less than half of Intel’s (205B$). I refuse to believe that the “potential for growth” of Nvidia is worth anywhere close to 120B$ in actual value even in the next 5 years. I see only two things here: either Intel is undervalued, or Nvidia is overvalued. I think it’s both. When that bubble bursts it’s going to hit very hard for a lot of people because it’s the same thing as the other big tech companies (apple google meta etc) are all valued based on predictions and magic when the companies that have an actual intrinsic value are worth less

Seems the strategy is clear mega short nvidia to buy super leveraged intel and hope you can stay solvent longer than the market is irrationnal

I agree this is an obvious market failure because finance bros have become detached from reality even more than usual.

AI boom is starting to smell like DOT COM 2.0.

We have not seen that much improvement since gpt4, mostly cost reduction and UI convenience.

Current AI hype is not cashable, and I say that as an enthusiast who is building 15 kilowatt inference cluster in his living room.

We already have the major improvements already and we are nowhere close to done disgesting then.

The problem with shorting is that it’s not clear when the crash will happen. If it happens next week, yes, you’ll make a giant fortune doing that. If it happens in a year, you’ll be fucked. Shorting is essentially a loan, and like any other loan, you have to pay in a little something for as long as you’re holding it. That can sap away all profit before you ever see it, if not sap away your entire savings.

There’s a saying around the stock market: the market can be irrational longer than you can stay solvent.

That said, I do think this crash is happening sooner rather than later. I’m just not confident enough to put money on it.

OK, what about this, implement the strategy and then, trigger war between Taïwan and China. They already want ont so bad, if for instance some Chinese war ship got its bridge blown up by a missile full of western electronic components while they were harrassing some fishermen in the straight. Since they’re already looking for an excuse, they might not need any further explanations to do what they were already going to do. It worked with the Maine and the Maddox and many other times in history.

Nvidia would probably cease existing without cheap Taiwanese labour to do all theoretical work for them so those shorts could be free money. A free trillion dollar just ready to be picked for one false flag attack, which, these things already happen all the time so, no big deal.

You’re way off base to the point where I’m not sure if you’re serious or not.

Nvidia would probably cease existing without cheap Taiwanese labour to do all theoretical work for them so those shorts could be free money

Nvidia uses TSMC, and it isn’t because of price. It’s a very expensive fab because it’s the best one in the world. If war blocked it from functioning, Nvidia would switch to some other fab. What they put out would be worse than what they had before, but nobody else would be able to make anything better, either.

But more likely, open war over Taiwan would tank the economy worldwide. Shorting Nvidia would only be a technical victory for yourself.

Cripple the global economy and erase trillions of gdp?

But then make a few millions off of it ?

Maybe even just 1 million of equivalent pre war purchasing power ?

Yeah I’d be absolutely all over that, awesome !

I mean, even if this snowballs into a worldwide failure cascade that kills billions, totally absolutely worth, it’s not even close to the alternative of having to work until I die.

Could even do it remotely with one of those remote operated jetski with starlink on them and a 500kg cargo capacity

How is Intel’s market cap less than their total assets?

Debt, both on-the-books and anticipated.

Intel’s investments in the Titanium chipset have effectively dead-ended. They can’t get below 7nm efficiently. Meanwhile, you’ve got companies in Taiwan, Korea, China, and Japan breaking into the 3nm and 2nm scales. To catch up, they’re looking at hundreds of billions if not trillions of dollars in technical debt.

Yes, they can keep churning out existing processors at huge profits in the moment. But the face value of these processors plummets with every new step in Moore’s Law. This amounts to asset depreciation, which means Intel’s value is heavily overstated on the basis of asset cost alone.

I won’t argue that NVIDIA is overvalued. But I think the degree to which they are overvalued is often misattributed to speculation and avoids the real specter haunting the company… competition. NVIDIA’s market dominance and the escalating demand for their technology means the sky really should be the limit for their growth. Demand for AI processing is at the forefront of these expectations. But a rival manufacturer capable of cutting into demand for their units would dramatically undermine their profitability.

Its the same with firms like Microsoft and Facebook and Boeing. So much of their dominance is predicated on the theory that people will never leave these walled gardens and their margins being enormous purely because they controlled a critical commodity/patch of technical real estate.

There was - incidentally - another enormous company that seemed to have the market cornered in its industry and got complacent with its R&D and long-term investment strategies… Intel.

Meanwhile, you’ve got companies in Taiwan, Korea, China, and Japan breaking into the 3nm and 2nm scales.

The mainland Chinese SMIC is doing everything they can without access to ASML’s EUV machines, and have gotten further than anyone else has on DUV. It remains to be seen just how far they can get without plateauing on the limits of that tech. Most doubted that they could get past 10nm, but some of their recent chips appear to be comparable to 7nm, and there are rumors that they have a low yield 5nm process that isn’t economically feasible but can be a strong political statement.

TSMC is delaying the transition to Gate All Around, announcing that they won’t be trying it on the 3nm processes, and waiting until 2nm to roll that out. They’re the undisputed leader today, so they’re milking their current finFET advantage for as long as it will sustain them.

Samsung has already switched to Gate All Around for their 3nm process, so they might get the jump on everyone else (even if they struggled with the previous paradigm of finFET). But they’re not lining up external customers, as their yields still can’t compete with TSMC’s. It’s entirely possible though that as the industry moves from finFETs to GAAFETs, Samsung could take a lead.

Intel basically couldn’t get finFETs to work, and are already trying to skip ahead to GAAFETs (which they call RibbonFET). Plus Intel (like the others) is trying to introduce backside power delivery, which, if it can be commercialized and mass produced, would achieve huge gains in power efficiency. Intel did introduce both technologies in its 20A process (supposedly 2nm class), but then canceled it due to low yield. So they’re basically betting the company on their 18A process, and hoping they can get that to market before TSMC and Samsung hit their stride on 2nm.

The mainland Chinese SMIC is doing everything they can without access to ASML’s EUV machines, and have gotten further than anyone else has on DUV.

You can’t say that, though, because it implies Chinese engineers and information technology scientists are trailblazers rather than plagarists and IP thieves.

Intel did introduce both technologies in its 20A process (supposedly 2nm class), but then canceled it due to low yield. So they’re basically betting the company on their 18A process, and hoping they can get that to market before TSMC and Samsung hit their stride on 2nm.

And I’ve got a few shares in my retirement account riding on that success. But its more a hedge against my own cynicism than a sincere expectation. Intel, like Boeing, seems far more interested in rewarding investors in the short term than maintaining a foothold in the market long term.

Intel is lagging behind AMD and NVidia with no sign of catching up. Meanwhile NVIDIA has a monopoly on AI.

It’s no wonder NVIDIA is worth far more now.

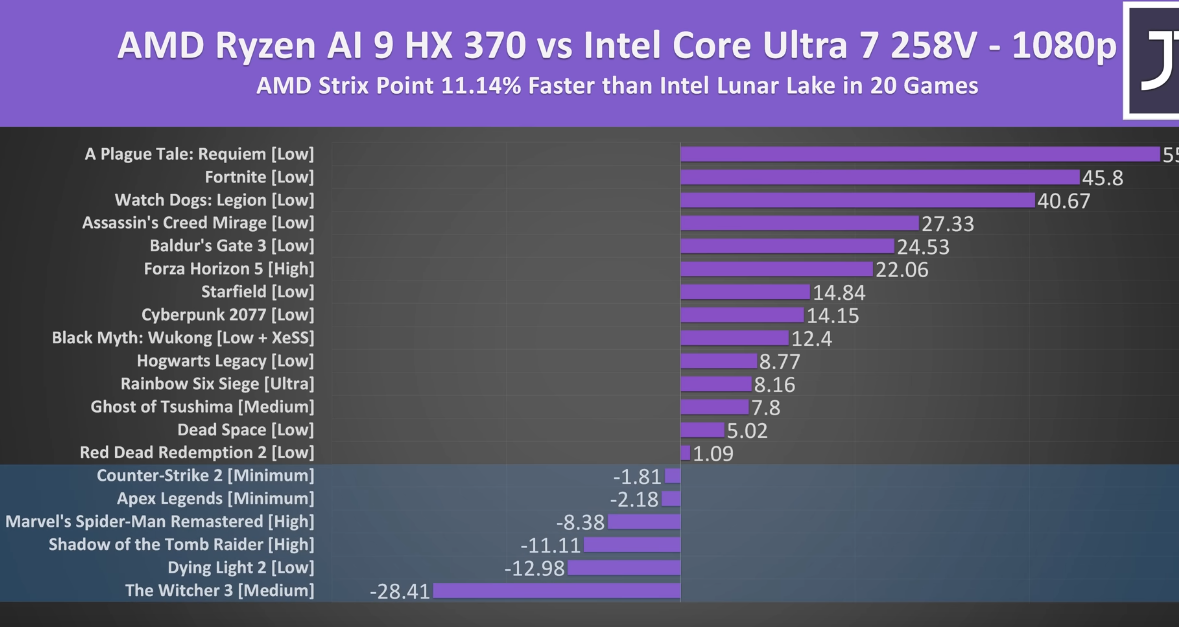

Intel have shown signs of catching up by putting out a better iGPU than AMD’s latest and greatest for laptop chips in certain games and most compute tasks. They’ve also put out one of the best laptop chips last month, they consume next to nothing while still having decent performance but go on I guess

Aren’t the best handhelds using AMD iGPU’s? The MSI Claw didn’t exactly leave a great mark. The new Radeon 890m looks pretty killer for its power efficiency.

The cpus I’m talking about have released about a month ago, but until very recently AMD were the only good options for handhelds

Just checked the new release, you’re right it’s looking pretty good. The AMD variant is still ~11% ahead in many games but it’s certainly much much closer than before. https://www.youtube.com/watch?v=IZkSoXPNBpA

I’m so excited for the AI crash

If this is all Nvidia stock let him try to cash out and see what happens.

The thing that bothers me when people say “oh its unrealized gains, it’s not real money” is that they use those unrealized gains as collateral for loans of real money. They effectively ARE that rich.

It’s BS that you can borrow against it. If he did sell it the valuation would drop.

As far as I’m concerned, that’s the point at which unrealized gains should be taxed: as soon as you’re using it as leverage